Results for the full year to 31 March 2022

BT Group plc (BT.L) today announced its results for the full year to 31 March 2022.

Philip Jansen, Chief Executive, commenting on the results, said “BT Group has again delivered a strong operational performance thanks to the efforts of our colleagues across the business. Openreach continues to build like fury, having now passed 7.2m premises with 1.8m connections; a strong and growing early take-up rate of 25%. Meanwhile, our 5G network now covers more than 50% of the UK population. We have the best networks in the UK and we’re continuing to invest at an unprecedented pace to provide unrivalled connectivity for our customers. At the same time we’re seeing record customer satisfaction scores across the business. “We have finalised the sports joint venture with Warner Bros. Discovery to improve our content offering to customers, aligning our business with a new global content powerhouse. Separately, we have strengthened our strategic partnership and key customer relationship with Sky, having now extended our reciprocal channel supply deal into the next decade and agreed a MoU to extend our co-provisioning agreement. “Our modernisation continues at pace and we are extending our cost savings target of £2bn by end FY24 to £2.5bn by end FY25. We delivered EBITDA growth of 2% this year as strong savings from our modernisation programme more than offset weaker revenues from our enterprise businesses due to well-known market challenges. “While the economic outlook remains challenging, we’re continuing to invest for the future and I am confident that BT Group is on the right track. As a result, we are today reconfirming our FY23 outlook for revenue growth, EBITDA of at least £7.9bn and also the reinstatement of our full year FY22 dividend, as promised, at 7.7 pence per share.” |

Strong progress in strategic priorities:

- Positive leading indicators: Highest ever BT Group NPS results; low Ofcom complaints; churn near record lows

- BT Group and Warner Bros. Discovery agreed to form a new premium sports joint venture bringing together BT Sport and Eurosport UK

- Agreed with Sky a new longer-term reciprocal channel supply deal beyond 2030

- Openreach signed a MoU on a framework with Sky on FTTP co-provisioning; Sky engineers to complete the majority of their FTTP in-premises provisioning activities on Openreach’s FTTP network

- FTTP footprint at 7.2m with annualised Q4 build rate of over 3m premises; take up of 1.8m driven by Equinox

- 5G network now covers over 50% of the UK population; our 5G ready customer base is over 7.2m and EE is once again named as having the best 5G and 4G network by RootMetrics

- Achieved gross annualised cost savings now totalling £1.5bn; increased target to £2.5bn by end FY25, within the previously communicated cost to achieve of £1.3bn

Adjusted EBITDA growth and return of full year dividend:

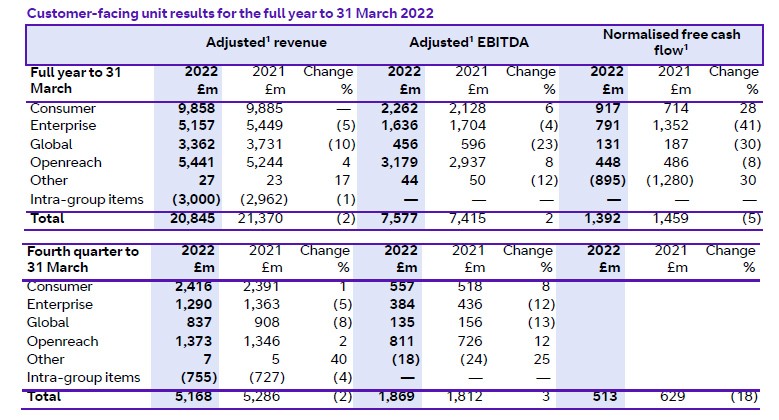

- Revenue £20.9bn, down 2%, reflecting revenue decline in Enterprise and Global offset by growth in Openreach, with Consumer flat for the year and returning to growth in Q4; adjusted1 revenue down 2%

- Adjusted1 EBITDA £7.6bn, up 2%, with revenue decline more than offset by lower costs from our modernisation programmes, tight cost management, and lower indirect commissions

- Reported profit before tax £2.0bn, up 9%, due to increased EBITDA offsetting higher finance expense

- Reported profit after tax £1.3bn, down 13%, due to remeasurement of our deferred tax balance

- Net cash inflow from operating activities £5.9bn; normalised free cash flow1 £1.4bn, down 5%, due to higher cash capital expenditure, offset by higher EBITDA and lower tax and lease payments

- Capital expenditure £5.3bn, up 25%. Capital expenditure excluding spectrum £4.8bn, up 14% primarily due to continued higher spend on our fibre infrastructure and mobile networks

- IAS 19 gross pensions deficit £1.1bn, (31 March 2021: £5.1bn) due to an increase in real discount rate, deficit contributions paid, changes to demographic assumptions and positive asset returns

- FY22 final dividend declared at 5.39p per share, bringing the full year total, as promised, to 7.70p per share

- Outlook for FY23: adjusted1 revenue to grow year on year; adjusted1 EBITDA of at least £7.9bn; capital expenditure excluding spectrum of around £4.8bn; normalised free cash flow of £1.3bn to £1.5bn.

1 See Glossary.

2 Includes investment in spectrum of £479m.

| Glossary of alternative performance measure | |

| Adjusted | Before specific items. Adjusted results are consistent with the way that financial performance is measured by management and assist in providing an additional analysis of the reported trading results of the Group. |

| EBITDA | Earnings before interest, tax, depreciation and amortisation. |

| Adjusted EBITDA | EBITDA before specific items, share of post tax profits/losses of associates and joint ventures and net non-interest related finance expense. |

| Free cash flow | Net cash inflow from operating activities after net capital expenditure. |

| Capital expenditure | Additions to property, plant and equipment and intangible assets in the period. |

| Normalised free cash flow | Free cash flow (net cash inflow from operating activities after net capital expenditure) after net interest paid and payment of lease liabilities, before pension deficit payments (including cash tax benefit), payments relating to spectrum, and specific items. For non-tax related items the adjustments are made on a pre-tax basis. It excludes cash flows that are determined at a corporate level independently of ongoing trading operations such as dividends, share buybacks, acquisitions and disposals, and repayment and raising of debt. |

| Net debt | Loans and other borrowings and lease liabilities (both current and non-current), less current asset investments and cash and cash equivalents, including items which have been classified as held for sale on the balance sheet. Currency denominated balances within net debt are translated into sterling at swapped rates where hedged. Fair value adjustments and accrued interest applied to reflect the effective interest method are removed. |

| Specific items | Items that in management’s judgement need to be disclosed separately by virtue of their size, nature or incidence. In the current period these relate to retrospective regulatory matters, restructuring charges, divestment-related items, Covid-19 related items, net interest expense on pensions, tax charge on specific items and the impact of the change in tax rate on our deferred tax balances. |

| Group NPS | Group NPS tracks changes in our customers' perceptions of BT. This is a combined measure of 'promoters' minus 'detractors' across our business units. Group NPS measures Net Promoter Score in our retail business and Net Satisfaction in our wholesale business. |

| 5G ready | EE consumer customers receiving or capable of receiving 5G network connection using one or both of a 5G enabled handset and a 5G enabled SIM. |

We assess the performance of the Group using a variety of alternative performance measures. Reconciliations from the most directly comparable IFRS measures are in Additional Information.

BT Group is the UK’s leading provider of fixed and mobile telecommunications and related secure digital products, solutions and services. We also provide managed telecommunications, security and network and IT infrastructure services to customers across 180 countries.

BT Group consists of four customer-facing units: Consumer serves individuals and families in the UK; Enterprise and Global are our UK and international business-focused units respectively; Openreach is an independently governed, wholly owned subsidiary, which wholesales fixed access infrastructure services to its customers - over 650 communication providers across the UK.

British Telecommunications plc is a wholly-owned subsidiary of BT Group plc and encompasses virtually all businesses and assets of the BT Group. BT Group plc is listed on the London Stock Exchange.

For more information, visit www.bt.com/about